I tried mining Ethereum on my home computer. Here’s what I found.

Last updated 1/4/2022.

Cryptocurrencies are a fascinating phenomenon, and one that I don’t fully understand. Bitcoin, the first ever cryptocurrency, was described by an open whitepaper by a mysterious individual named Satoshi, whose true identity has never been confirmed. What initially started as a theoretical and technical exercise in a small corner of the internet has now grown to be a globally-accepted, multi-billion dollar industry. There are now hundreds of cryptocurrencies, each providing a slightly different vision or implementation of the original concept. Of all the cryptos, however, Bitcoin remains king, with Ethereum following a distant second. (Note: technically the cryptocurrency on the Ethereum network is called Ether, not Ethereum, but I use them interchangeably in this article).

As an idea of how mainstream Bitcoin has become, the total market cap of Bitcoin now exceeds $1 trillion dollars. During its most recent earnings call in 2021, Tesla, a car company and the seventh largest public company in the world by market cap, revealed that it made more Q1 profits from buying and selling some Bitcoin than it had from selling cars!

I don’t know enough about the market dynamics of cryptocurrencies, the regulatory environment, or what their future holds, to discuss their merits as investments. Instead, I just wanted to have some fun and see what mining on a relatively average, 4 year old, self-built home computer (for PC gaming) would bring.

Cryptocurrency mining

Cryptocurrencies are not physical assets. Instead, they are digital rewards. Crypto networks use blockchain technology, which is a ledger of transactions, hosted in a de-centralized manner on a peer-to-peer network. The idea is that when a transaction is made on the network, participants on the network lend their computing power to validate the transaction and permanently record this onto the blockchain. In exchange for lending computing power to this task, the network rewards the participants with some amount of cryptocurrency.

In layman’s terms, this gives rise to cryptocurrency “mining”, because all cryptocurrencies are rewards from participating in a network. Basically, you can use computing power to validate network transactions (i.e. “solve puzzles”) and obtain coins as rewards for doing so. This version of mining is known as Proof of Work, or PoW. There are crypto networks that use other techniques, such as Proof of Stake and Proof of Space, but that’s a topic for a different time. This is a very simplistic explanation, but suffice it to say, anyone with a computer can do proof of work in theory. I should mention that in practice, modern crypto “mining” is done on a massive scale, mostly in China, with warehouses full of specialized hardware. You won’t be replacing your 9 to 5 anytime soon if you’re trying to mine on your home computer.

A crypto mining operation in China. Image source: Forbes.

This doesn’t deter people from trying, however, and with the price of cryptos such as bitcoin and ethereum skyrocketing in 2020 and 2021, more people than ever are trying to grab a slice of the pie.

Past 1 year price history of Ethereum as of 5/16/21. Yes, that is an 1,800% increase over the past year. And you thought stocks were in a bubble?

I decided to mine Ethereum, mostly because I saw a friend doing it. Ethereum also had, at the time I started, the best profitability. Finally, unlike Bitcoin, which essentially now requires dedicated machines called ASICs to mine profitably, it is still possible to mine Ethereum on consumer computer hardware.

My computer

My home computer, which is actually quite old (I built it 4 years ago in March 2017) has the following specs:

CPU: Intel Core i5 7600K, $199.99

Motherboard: MSI Z270 SLI Plus ATX, $132.49

GPU: MSI GeForce GTX 1070 8GB OC, $379.99

SSD: Crucial MX300 525GB, $149.99

Memory: 16 GB Corsair DDR4 2400Mhz, $99.99

PSU: Corsair RM650x 650W fully modular, $104.99

Case: Corsair Carbide 400C, $79.99

Prices were at time of purchase in 2017. Total cost including a few accessories, cables and fans was approximately $1200. It has functioned flawlessly for the past 4 years. Despite its age, even 4 years later, it still performs extremely well and I have no reason to upgrade anytime soon.

For various technical reasons, it turns out that the kind of computation needed for Ethereum mining is best performed by the GPU, or graphics processing unit. My GPU was a GeForce 1070 GTX, which is considered to be an upper-mid tier GPU. The top of the line GPU back then was a GeForce 1080 Ti with MSRP of $699. Top of the line GPUs are incredibly expensive, often costing more than the rest of the computer combined. They are also almost completely unnecessary for regular office work. For any PC gamer, however, the GPU is the single most important component in the entire computer.

Because GPUs are excellent at crypto mining, GPU prices tend to skyrocket when a crypto boom occurs. Right now, computer stores across the country are basically sold out of GPUs, and used GeForce 1070 GPUs like mine are going for between $400 to $500 on eBay, which is more than they originally cost when new. This would otherwise be completely unheard of when it comes to outdated and preowned computer hardware. The newest generation of top tier GPUs, the RTX 3000 series, are currently out of stock almost everywhere and are re-selling with huge markups for thousands of dollars.

Mining Ethereum

This is not a crypto mining guide, so I’ll gloss over some of the details. I found it relatively easy to start mining. It does take a little bit of research, and some familiarity with computers is obviously a plus, including using the command line interface (CLI), but deep technical expertise is not necessary. All in all, it took about 3 hours for me to do all the research and get everything set up, coming from zero prior knowledge. I created a crypto wallet (a place to securely store your cryptocurrency), joined an Ethereum mining pool (a group of miners who combine their computer power to increase the chances of mining successfully), downloaded the appropriate mining software for my GPU, tweaked the right commands, and began mining.

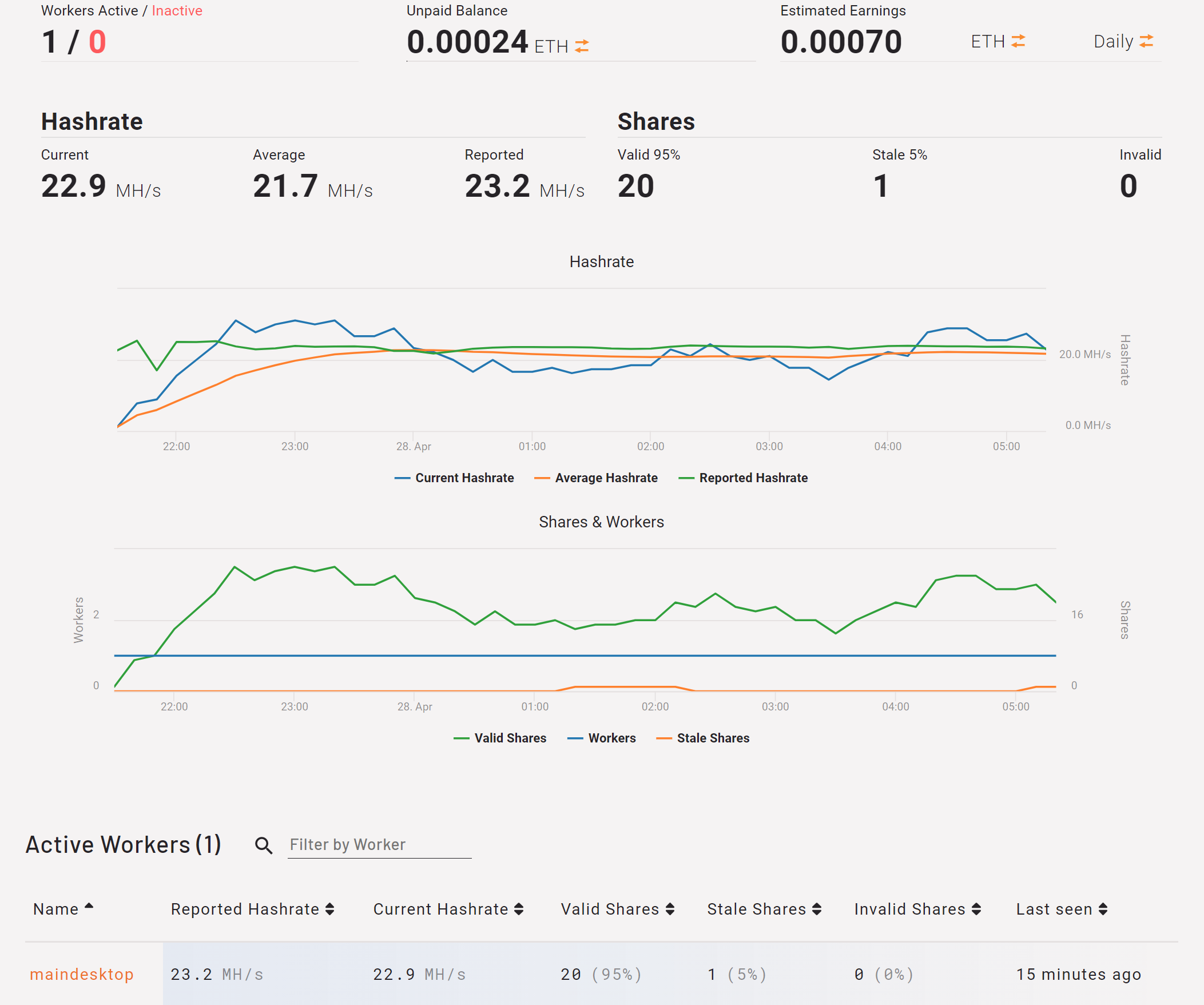

With Ethereum mining, speed is calculated by “hash rate”, which is basically how quickly your hardware can perform the necessary operations. With my GTX 1070 graphics card, I could get a speed of around 26 to 27 million (mega) hashes per second, or MH/s. However, I found that doing so caused the card to get quite hot and the cooling fans to run at 100%, which was loud. So I used widely available free tuning software to “underclock” my card’s core speed by about 10%. I ended up getting a speed of around 23 MH/s.

For comparison, some purpose built AISC mining rigs can mine at over 500 MH/s or even 1000 MH/s (or 1 GigaHash/s). And dedicated mining operations can run hundreds or even thousands of these machines.

How does 23 MH/s translate into Ethereum coins? This is not straightforward, because the “difficulty” of the blockchain network increases over time, so it takes more and more computing power to solve each problem. At the time (April 2021), 23 MH/s running for 24 hours yielded an estimated 0.00073 Ethereum per day, or about 0.022 Ethereum per month.

How much that is worth in USD obviously depends on the market price of Ethereum. The price of most cryptocurrencies fluctuate wildly, but in April 2021, 1 ETH was approximately $2,500 USD. So the estimated mining yield of my computer would be about $55 per month.

TRex mining software, getting about 23 MH/s on my GTX 1070 and drawing about 107 watts.

Of course, running the computer 24/7 incurs additional electricity costs. As you can see from the screenshot above, my graphics card draws between 100 to 110 watts when mining. My entire computer draws about 200 watts when mining, so if I left it on 24/7 for a month, it would draw 144kWh. The total price of electricity on my current service is 14 cents per kWh. This means $20 in electricity costs, reducing profits to $35 per month. The actual electricity cost would be lower, as this is assuming that if not for mining, my computer would never be used and draw no power. In fact, I found that I can mine and use my computer as usual without any noticeable difference, as long as it wasn’t a graphics-intensive activity (such as playing a game or rendering a video).

Results

Enough with the calculations. Let’s see if all of this actually works. I began mining on April 28, and on May 15, I exceeded the threshold set by the mining pool to get the first payout. This represents 17 days of mining. I wasn’t quite sure what to expect, but I did indeed receive a payout on May 15 into my personal Ethereum wallet:

So in 17 days, I mined 0.01748 Ethereum. This ended up being somewhat better than my initial estimate of 0.022 Ethereum per month. Using my actual mining rate, my renewed estimate is that I would mine about 0.03 Ethereum per month. The value of this mining, again, obviously depends on the market price of Ethereum. Interestingly, during these 17 days, the price of 1 Ethereum rose from around $2,500 to $3,800. Therefore, mining Ethereum was even more profitable than I originally calculated. If the price of Ethereum remains at $3,800, my estimated monthly mining revenue would be $117. After subtracting $20 in electricity costs, my monthly profits would be $97.

Is it worth it?

Well, it depends. While $100/month is not much in the grand scheme of things here in the United States, it can represent a much more substantial income in many poorer parts of the world. Beyond owning the requisite hardware (and the initial set-up), there are no further actions necessary on my part. Therefore, crypto mining is pretty “passive”. I can keep mining when I’m asleep or when I’m at work. In terms of return on investment, this means that my $400 GPU would pay for itself in about 4 months. And if I built another computer with the exact same specs to farm with, my entire computer would pay for itself in about 1 year. Another benefit of crypto mining is that it is very easily scalable. I can easily buy and run the equivalent of 10 of my GPUs and make $1,000/month. In fact, many people have been buying up all the graphics cards they can get their hands on, purely for this reason.

The profitability of mining any crypto, however, is incredibly dependent on the market price of that crypto. For example, if the price of Ethereum dropped to about $1,200, it would take 2 years of mining, instead of 4 months, for a $400 GTX 1070 GPU to pay for itself. If the price of Ethereum dropped below around $700, it would no longer even cover my electricity cost. In the 17 days I spent mining until my first payout, the market price of Ethereum ranged from $2,600 to a peak of $4,300 before falling to $3,800. And just in the 2 days since May 15 that I spent writing this article, the market price of Ethereum dropped from $3,800 to $3,400, over 10%. Cryptocurrencies are one of the most volatile asset classes in the world. The crypto industry has also seen some spectacular booms and busts which come in cycles. We are in a boom currently, but nobody knows if or when it might all come crashing down. A similar cycle occurred in 2017 - 2018, and when the price of Ethereum crashed, many people who spent thousands of dollars on computer hardware (at inflated costs) were suddenly faced with huge losses on unwanted hardware.

Therefore, I think mining might be worthwhile if you already have a computer that is capable of mining, because there’s no real risk (apart from prematurely aging your hardware). If you’re contemplating investing thousands of dollars on computer hardware purely for mining, however, there is a significant risk that the current crypto boom cycle will end and that you’ll be paying for overpriced hardware that will never pay for itself.

Personally, I found this little venture into cryptocurrency very worthwhile, not so much for the monetary value, but for the educational value. It has prompted me to do much more research into the nature of cryptocurrencies, how they are generated, the differences between some of the popular crypto networks, and some of the arguments behind their utility and their valuations. I’ll probably keep mining with my home computer for now, and I might post future updates on this topic. As always, happy investing!

05/19/21 update: less than 2 days after this article was published, the price of Ethereum has crashed to $2,600 and many other cryptocurrencies including Bitcoin have suffered 20%, 30%, or even 40% losses in a single day. This is a perfect illustration of the incredible volatility of cryptocurrency. For actual, sensible investing, check out my Investing 101 series!

01/04/22 update: I thought I would provide an update coming into the New Year. I kept mining intermittently over the past few months. As of December 31, 2021, I had mined a total of 0.133 Ethereum. The market price of Ethereum fluctuated wildly in 2021, ultimately ending the year at around $3,700. Therefore, I had mined approximately $492 worth of Ethereum after 8 months on my home computer.

This is why trading is dumb